Business Line Of Credit

Fund your path forward with financing on demand.

Financing at your fingertips ready to work for you, whenever you need it. From $5K up to $500K in as little as 24 hours.

Line Of Credit Custom-Built For Businesses.

Pay only for

what you use

Take as much as you need, as often as you like. You’ll only be charged interest on what you borrow, and you can feel confident knowing that you’ll always have funds when you need them.

Instant funding

on withdrawals

Receive your funds in real-time 24/7 via Interac e-Transfer®4. Withdraw as little as $500 right up to your approved limit with a few simple clicks.

Effortless

repayment

The ease of a single consolidated weekly repayment, no matter how many times you withdraw funds. We set up automatic repayments so you have one less thing to worry about.

Repay Your Way With Flexible Repayment Options.

Fixed Repayment

The best option if you prefer the predictability of a fixed, weekly payment.

Anytime you draw funds your balance will be consolidated into new fixed weekly repayment amount.

That amount will automatically be debited from your business bank account on the weekday of your choosing, because you have more important things to do.

Variable Repayment

The best option if you prefer to pay down your principal balance faster and save on interest.

Your payments are broken down into a percentage of your principal plus interest every week, decreasing over time.

Your weekly repayment amount will automatically be debited from your business bank account on the weekday of your choosing, so you have one less thing to worry about.

Stay Ready With A Business Line Of Credit.

Repairs

Inventory

Payroll

Cash Flow

Minor Expenses

Put your line of credit to work for a variety of business needs and keep things moving in the right direction.

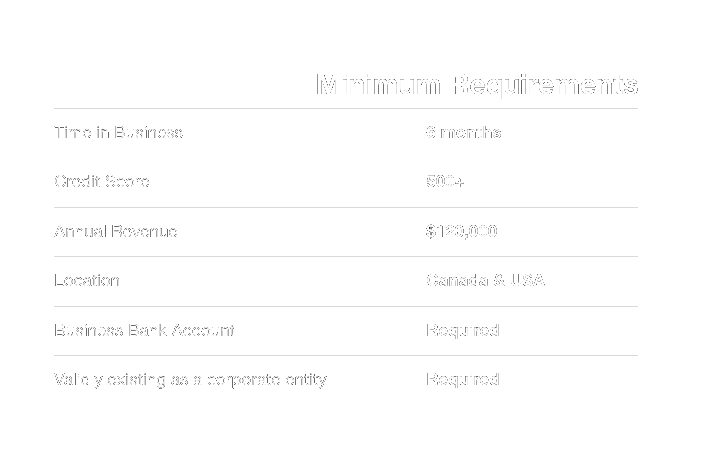

Are we a good fit for your business?

If your business meets the following basic criteria, our all-digital application process will have us on the way to helping you in minutes.

Apply Online, Hassle-Free

1

See if you’re eligible

In just a few clicks, check if your business is eligible to apply for a loan.

2

Apply online

We’ll ask for information about you, your business, its leadership and shareholders.

3

Sign and receive your funds

Once your application is approved, the funds will be directly deposited into your account.

Hear From Our Clients

Trusted By Businesses Like Yours

⭐️⭐️⭐️⭐️⭐️

"Kacu made the loan process incredibly simple. I applied online, got approved within hours, and had funds in my account the next day. Customer service was top-notch!"

— Ahmed M., Small Business Owner

⭐️⭐️⭐️⭐️⭐️

"Kacu was exactly what we needed when cash flow got tight. Their flexible line of credit helped us stay on top of payroll and vendor payments during a critical time."

— Michael P., Logistics Company Founder

⭐️⭐️⭐️⭐️

"The rates were competitive and the terms were clear. I used my loan from Kacu to consolidate debt, and it’s been a total game changer."

— Laura P., Marketing Consultant

⭐️⭐️⭐️⭐️

"Kacu gave me access to funds when my bank said no. They looked at the whole picture and not just my credit score. Grateful for the opportunity!"

— Melissa G., Entrepreneur

⭐️⭐️⭐️⭐️⭐️

"As a first-time borrower, I had a lot of questions. The team at Kacu was incredibly patient and helpful. I now have a line of credit that supports my seasonal business needs."

— Andre V., Landscaping Business Owner

⭐️⭐️⭐️⭐️

"The loan process with Kacu was refreshingly straightforward. Their team explained everything clearly and never made me feel rushed or pressured."

— Jon C., Apparel Business Owner

FAQs

Common Questions. Straight Answers.

-

A Business Line of Credit gives you flexible access to capital. You draw funds as needed, repay over time, and reuse the credit line as you pay it down.

-

It’s ideal for managing cash flow, handling unexpected expenses, or purchasing inventory. If your business has regular short-term financing needs, a line of credit offers flexibility.

-

To qualify, most businesses need to show at least 6 to 12 months of operating history and a minimum annual revenue of $120,000. Credit score requirements may vary, but Kacu Lending also considers your business’s cash flow and overall health, not just your credit score.

-

Fixed repayment means you repay your draw in regular daily or weekly installments with a set repayment amount.

-

Unlike credit cards, a line of credit typically offers lower interest rates, higher limits, and more flexibility for larger business purchases.

-

A Business Term Loan provides a lump sum up front with fixed repayments over a set period. A Business Line of Credit is revolving, so you can draw funds as needed up to your limit and repay flexibly. Term loans are ideal for big investments, while lines of credit are better for ongoing or unexpected expenses.

-

You’ll typically need to provide basic business information and recent bank statements. The process is quick and 100% online.