Business Loans

Reach your next milestone with fixed term financing.

A short-term infusion of capital to help boost your business to new heights. From $5K up to $500K in as little as 24 hours.

A Business Loan On Your Terms.

More choice

Whether you need a lot or just a little, we’re here to get you to that next milestone. Choose loan amounts ranging from $10,000 up to $500,000, with term lengths ranging from 4-24 months.

Repay your way

Choose the frequency that makes the most sense for your business and we’ll do the rest. We set up automatic repayments on your behalf because you have more important things to do.

Clear pricing

We offer competitive rates compared to other online lenders. Our lending advisors will clearly explain how pricing works so you can make the best possible decision for your business.

Unlock New Opportunities With A Business Term Loan.

New Equipment

Expansion

Advertising

Major Renovations

New Signage

Have big plans for your business? Put your term loan to work for everything you need to move forward.

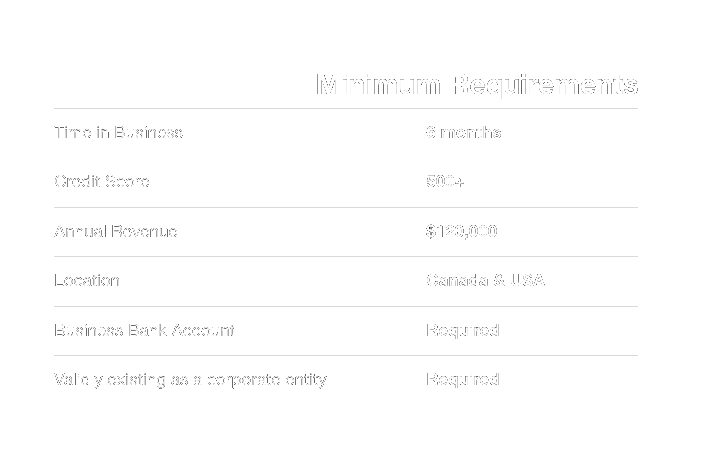

Are we a good fit for your business?

If your business meets the following basic criteria, our all-digital application process will have us on the way to helping you in minutes.

Apply Online, Hassle-Free

1

See if you’re eligible

In just a few clicks, check if your business is eligible to apply for a loan.

2

Apply online

We’ll ask for information about you, your business, its leadership and shareholders.

3

Sign and receive your funds

Once your application is approved, the funds will be directly deposited into your account.

Hear From Our Clients

Trusted By Businesses Like Yours

⭐️⭐️⭐️⭐️⭐️

"Kacu made the loan process incredibly simple. I applied online, got approved within hours, and had funds in my account the next day. Customer service was top-notch!"

— Ahmed M., Small Business Owner

⭐️⭐️⭐️⭐️⭐️

"Kacu was exactly what we needed when cash flow got tight. Their flexible line of credit helped us stay on top of payroll and vendor payments during a critical time."

— Michael P., Logistics Company Founder

⭐️⭐️⭐️⭐️

"The rates were competitive and the terms were clear. I used my loan from Kacu to consolidate debt, and it’s been a total game changer."

— Laura P., Marketing Consultant

⭐️⭐️⭐️⭐️

"Kacu gave me access to funds when my bank said no. They looked at the whole picture and not just my credit score. Grateful for the opportunity!"

— Melissa G., Entrepreneur

⭐️⭐️⭐️⭐️⭐️

"As a first-time borrower, I had a lot of questions. The team at Kacu was incredibly patient and helpful. I now have a line of credit that supports my seasonal business needs."

— Andre V., Landscaping Business Owner

⭐️⭐️⭐️⭐️

"The loan process with Kacu was refreshingly straightforward. Their team explained everything clearly and never made me feel rushed or pressured."

— Jon C., Apparel Business Owner

FAQs

Common Questions. Straight Answers.

-

A Business Term Loan is best for businesses with stable revenue looking to invest in growth, such as renovations, equipment, marketing, or hiring. You receive a lump sum upfront and repay it over time with fixed or variable payments.

-

A Business Term Loan is a good fit if you need access to a larger amount of capital and prefer predictable repayment over a fixed period. It’s best suited for established businesses with stable revenue looking to invest in long-term growth, such as store renovations, equipment purchases, marketing and advertising, website development, and more.

-

To qualify, most businesses need to show at least 6 to 12 months of operating history and a minimum annual revenue of $120,000. Credit score requirements may vary, but Kacu Lending also considers your business’s cash flow and overall health, not just your credit score.

-

Yes, in many cases. While credit score is a factor, Kacu Lending also evaluates your business’s performance and ability to repay. Many business owners with less-than-perfect credit still qualify.

-

Repayment is typically made through scheduled daily. weekly or monthly payments over a fixed term. Repayments may be automatically deducted from your business bank account.

-

Yes, you can repay your loan early. Depending on your agreement, you may save on interest. Your Lending Advisor can walk you through the details.

-

Repayment terms usually range from 6 to 24 months depending on your eligibility and loan amount. Your loan offer will outline the exact term based on your business’s needs and profile.

-

A Business Term Loan provides a lump sum up front with fixed repayments over a set period. A Business Line of Credit is revolving, so you can draw funds as needed up to your limit and repay flexibly. Term loans are ideal for big investments, while lines of credit are better for ongoing or unexpected expenses.

-

You’ll typically need to provide basic business information, recent bank statements, and proof of monthly revenue. The application process is 100% online and takes just a few minutes.

-

Kacu Lending offers both secured and unsecured term loans. Most of our small business loans are unsecured, meaning no collateral is required. Your loan terms will clearly state if any collateral is needed.